For external risks this is similar to internal risks. Risk management generally categorized as Internal and External risk management.

External risk management techniques are all market based tools in which expectations of future prices interest rates or foreign exchange rates are used in an attempt to profit off favourable movements.

Internal and external techniques of risk management. One way to express risk is to divide it into internal and external groups. Internal risk is risk to your companys bottom line from forces that come from within – disgruntled employees money lost due to poor communication and other risks that come from employees interacting with one another. External risk on the other hand is risk that comes from outside your company – negative public relations a recession or anything else that comes from external forces.

Internal risk management is about disaster aversion. External risk management is about the probability of loss. External risk management is strictly about the relative size of your bet.

Strictly it is about the degree of affordability of the worst possible loss. A lean approach practiced by many teams to identify and manage internal risks mostly includes. Build mitigation for common risks into the definition of done.

Generate stories for less common risks and add them to the project. Risk Management Process Introduction Risk - Internal and External Contexts Legal Risk Assessment Criteria for Legal Risk Assessments Legal Risk Identification Communication and Collaboration Legal Risk Analysis Likelihood and Consequences 3 Big Problems in Risk Management. External risk management techniques are all market based tools in which expectations of future prices interest rates or foreign exchange rates are used in an attempt to profit off favourable movements.

For example an option could be used for a future transaction at a price agreed today. The buyer of the option gains the right-but not the obligation to buy the good for an agreed. There are various Foreign Exchange Risk Management Techniques and strategies that can be classified into internal and external techniques.

It should be a policy to use internal techniques and control risk internally external strategies are applied only when internal techniques cannot solve the problem or cannot deal with the risk. For external risks this is similar to internal risks. For example as a measure you can inform the sponsor and management external risk more often and better about the project and get feedback so that they do not decide something what is harmful to the project.

Internal risks include personnel management such as labor shortages or poor morale and technology issues such as outdated software. External risks include economic slowdowns leading to lower. The following points highlight the techniques used to manage foreign exchange risk.

Pre-Emptive Price Variation 3. Maintaining a Foreign Currency Bank Account 5. Discounting of Bills of Exchange 8.

Money Market Operations and a few others. Risk management generally categorized as Internal and External risk management. INTERNAL RISK MANAGEMENT - When the riskproblem takes place within the firm in general working days and can be controlled by the working parties Employers and Employees.

Financial risk management aims to protect the firm from these risks by using several financial instruments. It can be quantitative and qualitative both. Investment and Financial Risk Management subject involves managing the relationship between internal aspects of financial institutions and the external factors that influences the investment.

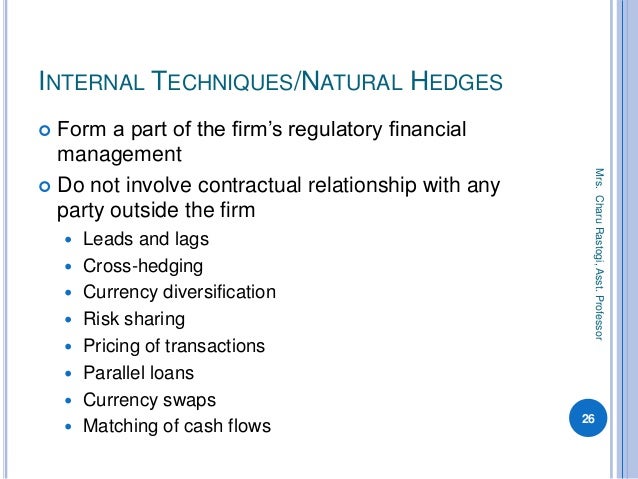

This article throws light upon the four main techniques to manage foreign exchange risk. Examples of External Sources of Risk Economic o Availability liquidity market factors competition Social o Consumer tastes citizenship privacy terrorism demographics Equity o Socialeconomicenvironmental injustices racial profiling unequal access conscious and unconscious bias institutional racism underrepresentation Technology. AGENDA Risk definition and measurement Hedging tools and techniques Internal andExternal2MrsCharuRastogiAsstProfessor.

FOREX RISK Foreign exchange risk also known as exchange raterisk or currency risk is a financial risk posed by an exposureto unanticipated changes.