Capital leverage funding and liquidity. This whitepaper summarizes the changes.

That is the Tier 1 Capital should be at least 3 or more of the total consolidated assets incl.

Basel 3 banking rules. Capital requirements are also a part of Basel III. Banks are required to hold 45 of risk-weighted assets in the form of their own equity. This rule is an effort to make banks have skin in the.

Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09. The measures aim to strengthen the regulation supervision and risk management of banks. Like all Basel Committee standards Basel III standards are minimum requirements which apply to.

Basel III is a set of international banking regulations developed by the Bank for International Settlements to promote stability in the international financial system. The Basel III regulations are. Basel III is a comprehensive set of reform measures in banking prudential regulation developed by the Basel Committee on Banking Supervision to strengthen the regulation supervision and risk management of the banking sector.

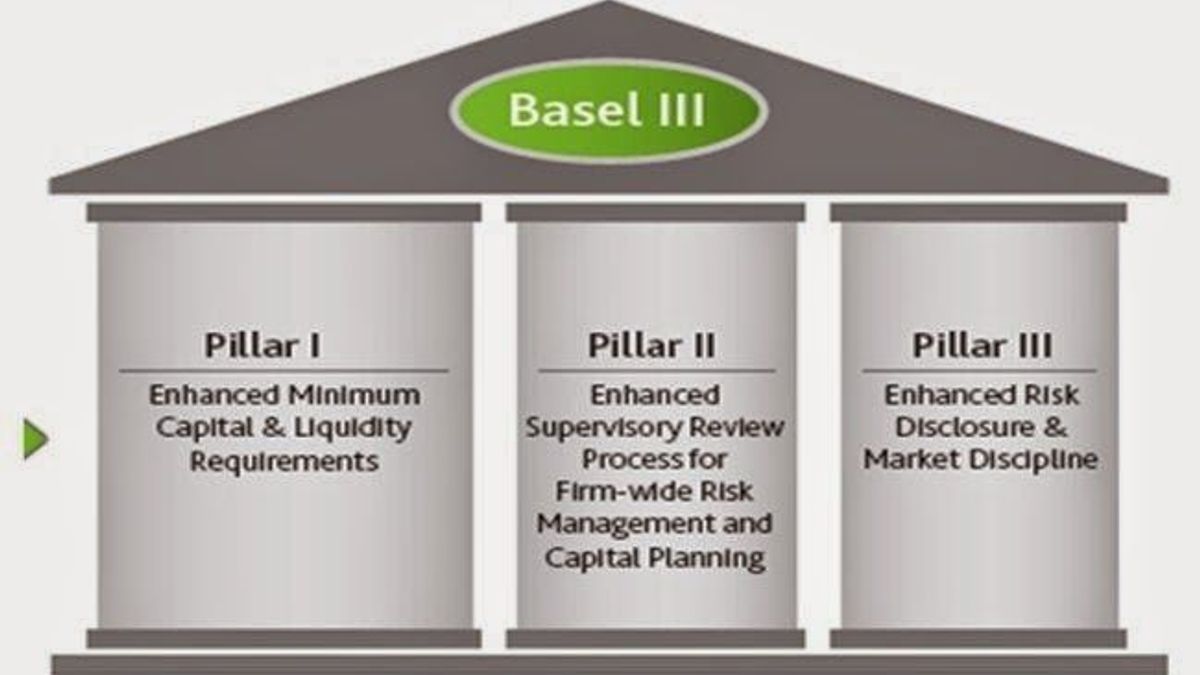

These measures aim to. Basel Committee on Banking Supervision reforms Basel III Strengthens microprudential regulation and supervision and adds a macroprudential overla y that includes capital buffers Capital Liquidity Pillar 1 Pillar 2 Pillar 3 Global liquidity standards and supervisory monitoring Capital Risk coverage Containing leverage Risk management. Basel III Implementation.

Full timely and consistent implementation of Basel III is fundamental to a sound and properly functioning banking system that is able to support economic recovery and growth on a sustainable basis. Consistent implementation of Basel standards will also foster a level playing field for internationally-active banks. By a banking institution when implementing a Basel program.

Section 5 provides an overview of Capgeminis Basel related capabilities and Section 6 provides conclusive remarks. The scope of this paper is the Basel III US. Introduction The new set of Basel regulations includes many enhancements to previous rules and will.

122 Overview of risk disclosure requirements 288 123 Practical implementation challenges 307 124 Conclusion the future of risk management disclosures 312 13 Taxation 315 Matthew Barling and Anne-Marie Stomeo 131 Introduction 315 132 The taxation environment for banks 315 133 Tax implications of Basel III proposals 322 134 Conclusion 331. Minimum Tier 1 capital increased from 4 in Basel II to 6 in Basel III comprising of 45 of CET1 and an additional 15 of AT1 Additional Tier 1 Leverage. Banks must maintain a leverage ratio of at least 3.

That is the Tier 1 Capital should be at least 3 or more of the total consolidated assets incl. Non-balance sheet items Liquidity. Basel III norms aim at making most banking activities such as their trading book activities more capital-intensive.

The guidelines aim to promote a more resilient banking system by focusing on four vital banking parameters viz. Capital leverage funding and liquidity. Presently Indian banking system follows Basel II norms.

Basel III is a comprehensive set of reform measures developed by the BCBS to strengthen the regulation supervision and risk management of the banking sector. The measures include both liquidity and capital reforms. The Basel III requirements were in response to the deficiencies in financial regulation that is revealed by the 2000s financial crisis.

Basel III was intended to strengthen bank capital requirements by increasing bank liquidity and decreasing bank leverage. Basel III summary In December 2010 the Basel Committee on Banking Supervision BCBS published its reforms on capital and liquidity rules to address problems which arose during the financial crisis. This whitepaper summarizes the changes.

Elisa Achterberg Hans Heintz October 2012. The Final Rules and Basel IIIs minimum requirement for that ratio is 3 and like in the Proposed Rules the Final Rules include the supplementary leverage ratio as a metric for the prompt corrective action PCA regulations as applied to depository institutions that are advanced approaches banking organizations. Basel 3 rules will wreck gold price suppression LBMA warns Bank of England May 10 2021 2900 Pending Basel III regulations emanating from the Bank for International Settlements could destroy the clearing and settlement system for unallocated paper gold.